Source from imoney.my (written by iMoney Editorial)

If you are a car owner and have been paying for your car insurance without an inkling of what determines your premium, you have come to the right place.

Like all other types of insurance, auto insurance premium rate in Malaysia is subject to regulation, and all companies are required to use the same basis of premium rate.

After the liberalisation of the motor insurance industry in 2017, insurance companies generally have their own risk profiling to assess what the insurer will ultimately charge for the premium.

This rate is determined by several factors, such as:

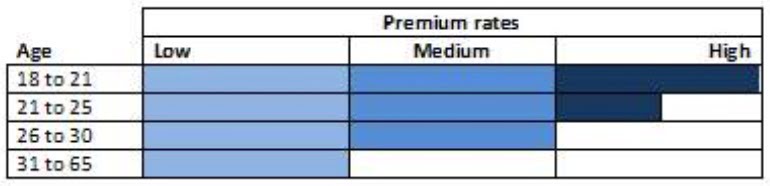

1) Age of the car owner. Most companies have similar age groups categorisation. According to PIAM (Persatuan Insurans Am Malaysia), statistics have shown most serious accidents were recorded by motorists aged between 17 and 23 years. This translates to a higher premium rate for younger drivers.

2) Driving experience. This refers to the number of years the driver has been holding a driving license and not the actual driving experience.

3) Nature of occupation. This is determined by whether your job is based indoor or outdoor. For example, sales job is considered mostly outdoor and it will have a higher rate.

4) No claim discount (NCD). Each private car owner is entitled to NCD ranging from 25% to 55% as provided in their individual policy. The maximum NCD offered currently is at 55%.

7) Engine capacity (cc). This refers to your car engine capacity or most commonly known as cc. The lower the cc, the lower the premium.

8) Year of manufacture. The year your car is made or registered will affect the premium. Generally, the older the car, the lower the premium.

9) Type of car. This refers to the vehicle type such as saloon, MPV, SUV or 4-wheel drive. Some company charges differently depending on the car type.

10) Type of engine. It’s important to know that most car insurance company impose higher car insurance premium on cars with turbo engine. Some insurers even reject cars with turbo engines.

11) Gender of car owner. This may not apply to every insurance company, but some do charge lower premiums for male driver or vice versa. This could be based on their own company’s statistics used in their risk profiling.

As a general rule of thumb, if you are purchasing an auto insurance for a new vehicle, the sum insured should be the purchase price. For older vehicles, you should insure based on the market value. It is always better to insure more than less – that way you can be sure you will receive full payment in the event of a claim.

If you wish to purchase your insurance with a new company but continue to receive a NCD that you had with a previous insurer, you can ask for a letter proving your NCD status from your previous insurer. Your NCD can also be transferred if you change your vehicle.

This article was first published in 2013 and has been updated for freshness, accuracy and comprehensiveness.